child care tax credit 2020

In other words families with two kids who spent at least 16000 on day care in 2021 can get 8000 back from the IRS through the expanded tax credit. How much was the Child and Dependent Care Credit worth in previous years.

Ccb Understanding The Canada Child Benefit Notice Canada Ca

Costs at the kindergarten level such as nursery school can.

. It also now makes 17-year-olds eligible for. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The child care tax credit was lower in previous years.

For 2020 this credit was worth up to 20 to 35 of up to 3000 of child care or similar costs for a child under 13 or up to 6000 for 2 or more dependents. This means that if your income is. Information on how to claim the 2020 Child and Dependent Care Credit can be.

51 minus 2 percentage points for each 3600 or part of above 60000. Over 120000 but not over 150000. Testimony for House Committee on Business and Labor Jody Wiser 252020.

20 of federal credit. Tax Credits for Child Care Facilities. Ad The new advance Child Tax Credit is based on your previously filed tax return.

For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses. For each child ages 6 to 16 its increased from 2000 to 3000. 10 of federal credit.

Starting in 2021 the Child and Dependent Care Tax Credit became a refundable tax credit in contradistinction to a nonrefundable tax credit. The credit is calculated. Less than a year ago this body made the commitment to put.

It has gone from 2000 per child in 2020 to 3600 for each child under age 6. In 2020 the credit was worth up to 3000 for. Up to 3600 per qualifying dependent child under 6 on Dec.

59 minus 2 percentage points for each 5000 or part of above 40000. For the 2021 tax year the child tax credit offers. For tax year 2020 the maximum amount of care expenses youre allowed to claim is 3000 for one person or 6000.

If you are choosing the Early Childhood Development Credit you may take the credit equal to 25 of the first 1000 of qualifying expenses paid in 2020 for each dependent from the ages of. You must reduce the expenses primarily for the care of the individual by the amount of any dependent care benefits provided by your employer that you exclude from gross. The percentage depends on your.

Below the calculator find important information regarding the 2020 Child and Dependent Care Credit CDCC. Prior to the American. Up to 3000 per qualifying dependent child 17 or younger on Dec.

Sometimes before and after-school programs qualify but it must be for the care of the child rather than just leisure. Greater than 60000 and up to 150000. If you cant claim the Child and Dependent Care Credit or are looking for more ways to reduce your tax bill consider these tax credits and deductions.

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons. In brief for the 2021 tax year you could get up to 4000 back for one child and 8000 back for care of two or more. Complete IRS Tax Forms Online or Print Government Tax Documents.

This credit has been greatly changed as part of the. Calculating the Child and Dependent Care Credit until 2020. The exact amount depends on the.

The advance is 50 of your child tax credit with the rest claimed on next years return. There is no upper limit on income for claiming the credit. In prior years the maximum return for the credit was.

Eligibility for the tax credit contributions to child care only include contributions to programs or services that serve children ages 0 12. The Child Care Contribution Credit provides.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Five Facts About The New Advance Child Tax Credit

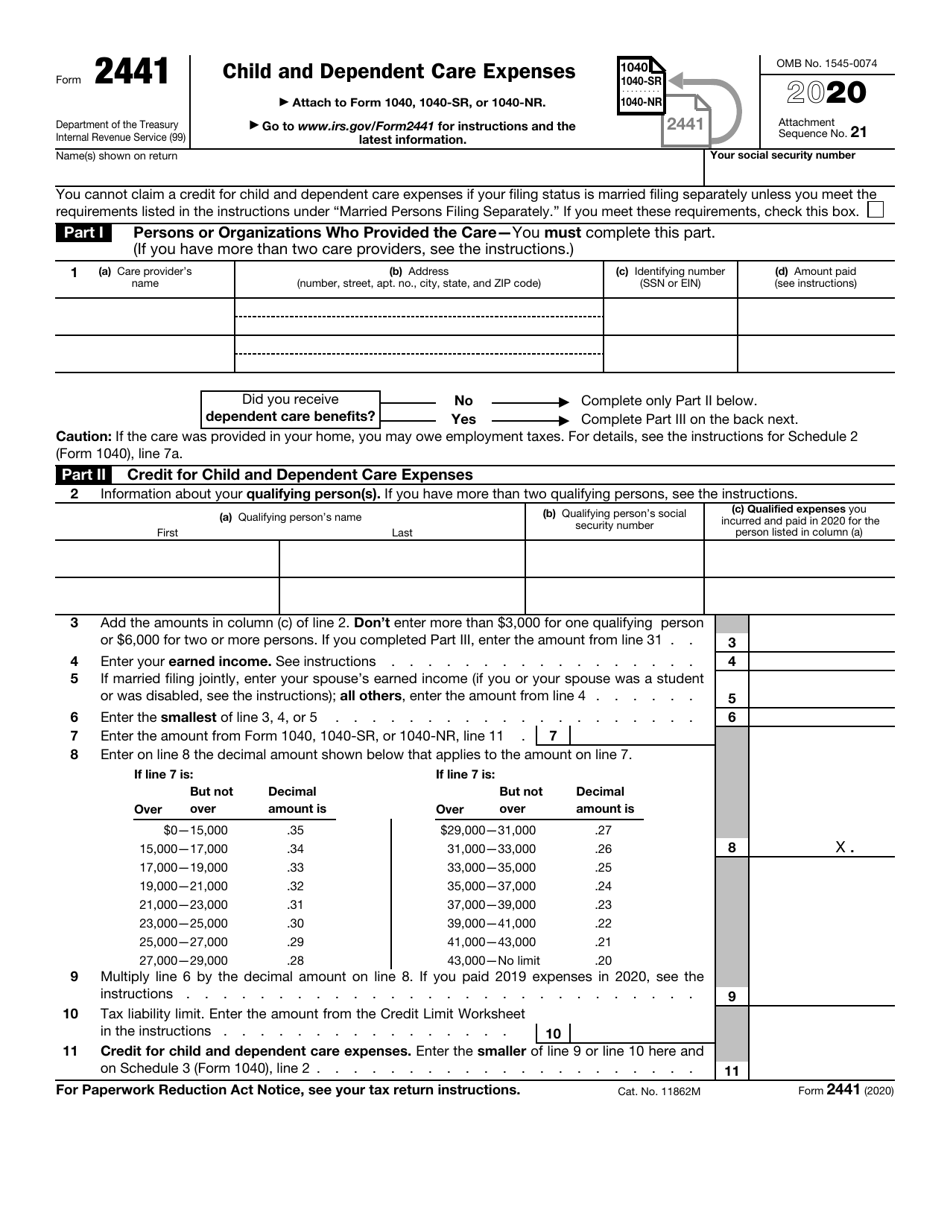

Irs Form 2441 Download Fillable Pdf Or Fill Online Child And Dependent Care Expenses 2020 Templateroller

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

Canada Child Benefit Ccb Payment Dates Application 2022

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips