how does inheritance tax work in florida

The only good thing about being married is the Inheritance Tax free benefit. If someone dies in Florida Florida will not levy a tax on their estate.

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

Inheritance tax only applies when the beneficiary inherits property from someone who lived in a state that has an inheritance tax.

. The tax free allowance for every individual is 325000 until 2026 announced in the Financial Bill 2021 though theres no certainty if it is predicted to increase or decrease I would not rule it out. An inheritance tax is a tax on assets that an individual has inherited from someone who has died. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

The only other way that inheritance can result in taxation in Florida is when it counts as income. Browse Get Results Instantly. It matters only where the deceased lives not the beneficiary.

Florida does not impose an inheritance tax nor does it impose an estate tax or gift tax on inheritance. The tax rate varies depending on the relationship of the heir to the decedent. An inheritance tax is a state tax you have to pay on property or money you receive from someone who has passed away.

Its against the Florida constitution to assess taxes on inheritance no matter how much its worth. You dont have to pay inheritance taxes on an inheritance in Florida. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Because Florida has no income tax even on pensions social security and retirement accounts inheritance is not even taxable as income for Florida residents. Just a few strategic financial moves by a Florida estates attorney could save you nearly half of your estate. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate.

Youll need to check the laws of the state where the person you are inheriting from lived. Moreover Florida does not have a state estate tax. In Pennsylvania for instance the inheritance tax may apply to you even if you live out of state as long as the deceased lived in the state.

This applies to the estates of any decedents who have passed away after December 31 2004. The fact that Florida has neither inheritance nor estate taxes on the state level does not mean that the states residents dont have to worry about the Death Taxes at all. Inheritance tax doesnt exist in Florida at any level.

Most assets devised through a will inheritance process will not result in tax liability. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. If your parent owned the house for a very long time then the property taxes will go up a lot.

This means if your mom leaves you 400000 you get 400000 there are no taxes to pay. For example if you live in Florida and you inherit money from an uncle who lives in Kentucky which is one of the six states that does impose an inheritance tax you may owe. Dont confuse the inheritance tax with the federal estate tax which is tacked on estates worth more than 117 milllion.

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax. It is arguably one of the best states in the country for giving or.

The state where you live is irrelevant. Ad Inheritance and Estate Planning Guidance With Simple Pricing. A very small number of states have inheritance taxes and again Florida is not one of them.

First the property taxes will go up if you inherited the persons homestead and you have your own homestead. The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. There is no inheritance tax in Florida but other states inheritance taxes may apply to you.

An inheritance tax is a tax levied against the property someone receives as an inheritance. While the estate tax is calculated and taken out from the estates worth before it is passed to heirs inheritance tax is directly the heirs responsibility. Ad Search For Info About Does florida have an inheritance tax.

However its important to point out that with estate and inheritance taxes these taxes could apply to the. If an individuals death occurred prior to that time then an estate tax return would need to be filed. An inheritance is not necessarily considered income to the recipient.

An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an. Federal Estate Tax.

There isnt a limit on the amount you can receive either any money you receive as an inheritance is tax-free at the. Florida is one of those states that has neither an inheritance tax nor a state estate tax. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40.

Florida also has no gift tax. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. If the person giving them the property lived in one of the six states that do levy an inheritance tax that state would collect an estate tax.

There are no inheritance taxes or estate taxes under Florida law. If you have a spouse you can transfer any of your unused IHT. Taxing Inheritance as Income in Florida.

Second the income taxes from the sale of the house will not be too bad. FindInfoOnline Can Help You Find Multiples Results Within Seconds. There is no inheritance tax in Florida but other states inheritance taxes may apply to you.

What are the tax implications of inherited property in Florida. Florida doesnt collect inheritance tax. Inheritance tax only applies when the beneficiary inherits property from someone who lived in a state that has an inheritance tax.

An estate tax is a tax on a deceased persons assets after death. The inheritance tax in Florida is the legal rate at which the state of Florida taxes the estate of a deceased person.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Probate Access Your Florida Inheritance Immediately

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

State Estate And Inheritance Taxes Itep

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Estate Tax Rules On Estate Inheritance Taxes

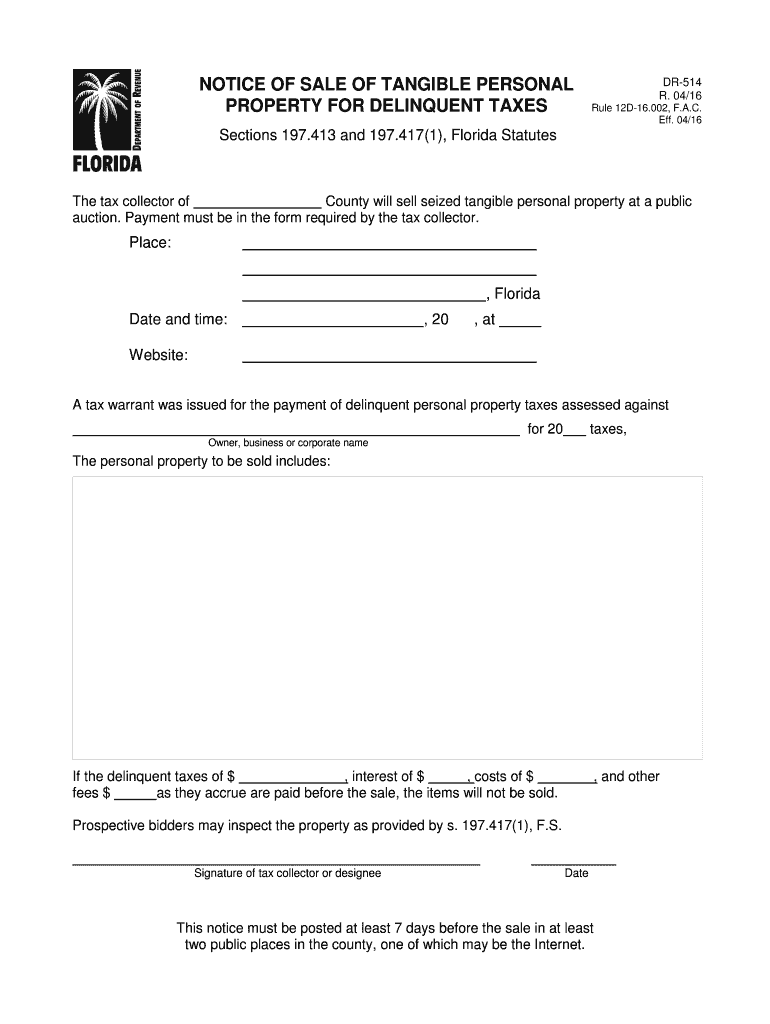

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

State Estate And Inheritance Taxes Itep

Florida Inheritance Tax Beginner S Guide Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax In Switzerland Guide Rules For Estates Studying In Switzerland

Florida Inheritance Tax Beginner S Guide Alper Law

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)